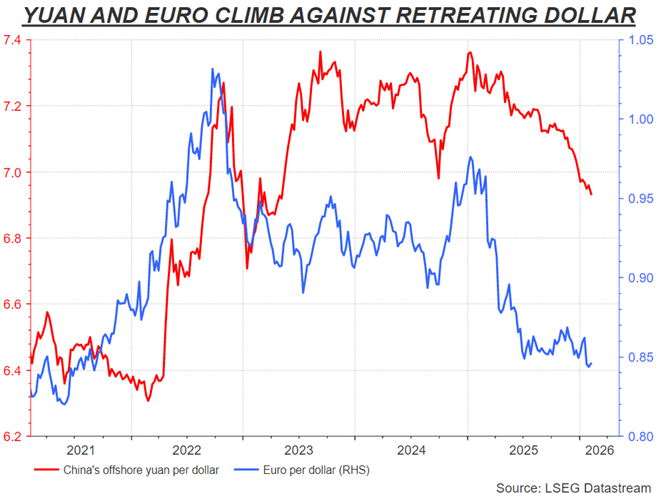

The US Dollar is sliding against the Euro and the Yuan, when leaders of both countries are seeking to boost their currencies

Reuters- The dollar is sliding against the euro and yuan as the Chinese and European leaders are pursuing for increasing the role of their currencies in global trade after taking advantage of rising doubts about the dollar. The latest shift in the exchange rate is considered to be in a playful mode, as expected by all parties.

With the upcoming Lunar New Year holidays, China’s offshore yuan has increased to its best levels against the dollar in nearly three years. The greenback has lost 6% against the renminbi since the beginning of last year.

The 15% increase in the euro against the dollar during the same period is even more distinct, as the exchange rate approaches the five-year high above $1.20 last month. This strategic move is aligned with the jawboning of leaders across both countries.

On Thursday, European Central Bank Sources stated that the ECB was planning to support its long-standing commitment to the global euro by extending euro liquidity to more countries and making it cheaper and easier to use the euro internationally, thus strengthening the currency’s international role.

In response to this, Martin Kocher, Chief of Australia’s central bank, stated that the ECB must be ready for a huge shift as they are observing increasing interest in euros compared to their counterparts, making it a safe-haven.

In the meantime, China’s president, during a series of top-level trade visits and calls for an equal multipolar world, restated Beijing’s desire for a powerful currency in world reserves and global trade and finance firmly.

It seems that both regions have sensed the reconsideration among global investors about the overwhelming dominance of the dollar in world finance ahead of the US’s aggressive and disruptive trade and diplomacy policy.

However, embracing a weakening dollar is one thing, while the implications of a new world in which the US administration welcomes a weakening dollar are another thing. So, all parties should take the next step carefully.

The ongoing assumption is that Washington is comfortable with the depreciation of the dollar that is entailed with a significant shift in cross-border investments required to reduce global imbalances. Since Trump considered the January’s sharp decline in the dollar as great news.

Secretary of the Treasury Scott Bessent also reiterated the historical “strong dollar” belief; however, he pointed out that it does not imply anything about current exchange rates. The depiction of a “strong dollar” reflects the future policies that would strengthen the currency over time.

Read: The US Bond Market is Flashing Warning Signs about the Economy

Nevertheless, there are still questions about the possibility of implicit agreements regarding the various bilateral trade agreements, especially in Asia, that have been developed and executed by Trump.

Regardless of what the leaders’ plans for internationalization of their currencies are or what is going on under the surface, the markets are resisting any notion of recovering from their early January dollar depreciation.