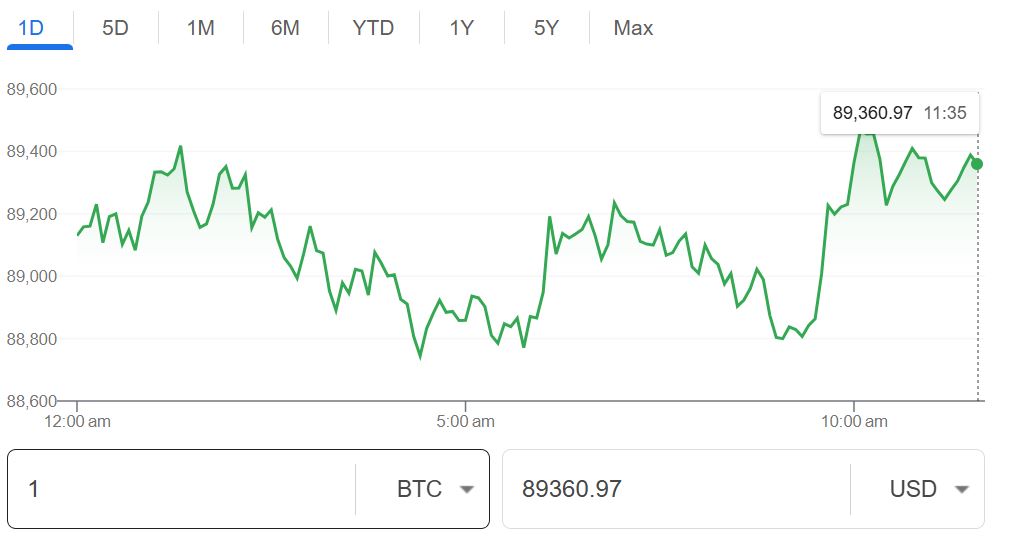

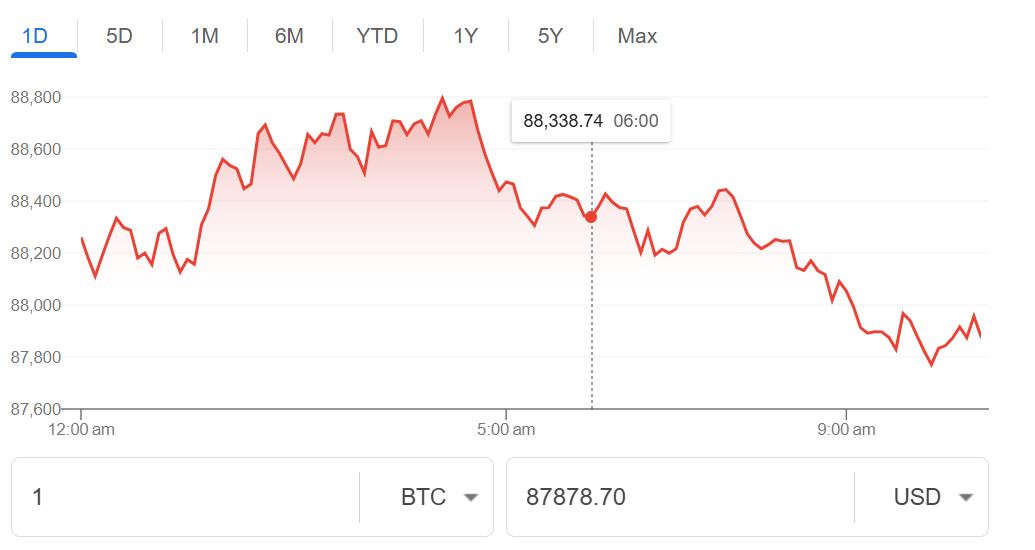

The crypto market is exhibiting signs of reviving again. Since the harsh selling-off, Bitcoin has shown a comeback of double digits, increasing 12% from its recent drops. Presently, Bitcoin is trading at $70,998, indicating that, being a real crypto king, it can navigate through the complexities of the crypto world better than others.

However, the experts are still warning that the visible green charts do not present the complete picture, and investors should remain cautious.

Here is a brief explanation of what is actually happening and what its consequences could be its consequences

Short Squeeze

The current increase in the Bitcoin price is primarily attributed to short squeeze. In other words, the majority of traders were betting that Bitcoin prices would keep falling. However, when the prices went up surprisingly, these traders were forced to buy Bitcoin to avoid losing all of their money. This forceful purchasing created a domino effect and led the prices higher.

Ryan Yoon from Tiger Research argued that the market was too oversold, and a bounce back was unavoidable, a technical reaction to a panic week.

Increased Buying Among US Investors

Coinbase Premium Index is an important bright spot that estimates how much US investors are investing in Bitcoin as compared to the rest of the world. The index was in deep red on Friday, but since the increase in Bitcoin price, it has surged to 70%, indicating a revival of Americans’ interest in Bitcoin.

Read: Gold Targets $5,100: Why the World’s Safest Asset is Gaining Momentum

Is It a Dead Cat Bounce?

Despite the price tag of $70,000, the majority of analysts are using a serious term, i.e., dead-cat bounce. The term is widely used in Wall Street that indicates a recovery after a major crash that may not retain in the long-term.

Andri Fauzan Adziima of Bitru argues that fresh demand is still missing as investors are currently closing the old bets and they are not opening the new ones. To ensure a genuine trend reversal, experts indicate that two things are required:

- Macro stability through improved US economic data (steady jobs and lower inflation)

- Structural shifts (Big strategic moves like countries adding Bitcoin as their national reserves along with gold)

Impact on the Global Market

The recovery is not happening in a vacuum. In Asia, the stock market has felt a significant impact as Japan’s Prime Minister Sanae Takaichi won a landslide election. The Nikkei 225 index increased by 5%, which relaxed the global investors and transformed the risky assets like Bitcoin into more attractive.

What’s Next

Currently, the focus is moving away from tech companies’ earnings. The future ahead looks promising if the US economy remains strong and regulators continue to warm up to stablecoins. Although Bitcoin has stabilized the ship for now, whether it sinks back or sails for new highs is dependent on Bitcoin’s capability in withstanding the relief and turning it into lasting demand.