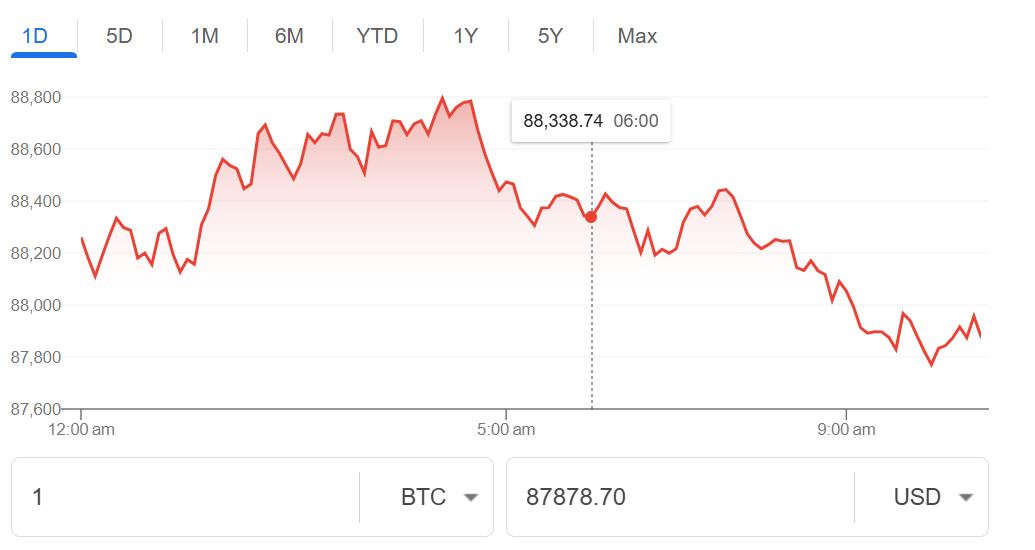

Bitcoin dropped below $71,000 in Asian hours on Thursday. This random was not an arbitrary event; it is considered a splash stemming from the massive sell-off in the technology stocks worldwide that spilled over into the crypto world.

Last week’s volatility dashed the hopes of any recovery as Bitcoin, the world’s largest cryptocurrency, fell by 7.5% and was recorded at $70,700.

AI Fatigue

This extreme market uncertainty is primarily attributed to AI Fatigue, as investors are getting too nervous about AI, since they have been investing in tech, especially AI, for the previous months. However, the earnings reports released by tech giants like Arm, Alphabet, and Qualcomm have fuelled anxiety among investors.

The investors have started thinking: are they spending excessively on AI with little or no returns? This increasing anxiety has driven the Asian stocks as the KOSPI Index dropped by 4% and the NASDAQ in the US also followed the similar suit. Bitcoin is now considered a high-risk tech stock, and it bleeds along with the big tech stocks.

The Huge Flush of 2026

The majority of the experts argue that the Bitcoin’s price blow $71,000 has instigated a deleveraging event as the traders who had bet on Bitcoin by borrowing money are pressurized to sell their positions instantly to pay back their loans.

The COO at Synfutures, Wenny Cai has explained it as a flushing out of crowded bets. She further highlighted that the market is no longer defined by hypes or cool stories, rather it is driven by the mechanics of balance sheets. The investors are selling because they are pressurized to do so not because they are interested to do so.

However, this is not the end of the big organisations buying crypto, rather it is the end of investors’ false assumptions that prices will only go high.

Gold and Silver Join the Commotion

Besides crypto, the prices of gold and silver also experienced a sharp decline as sliver dropped by 17% and gold fell by 3%.

Read: Silver’s 17% Crash Outpaces Bitcoin in Historic Liquidation Chaos

This generated a double whammy effect for crypto traders who preserved tokenized metals (digital versions of gold and silver). The crashing of physical metals instigated even larger liquidation among crypto exchanges, generating a freefall in the whole market.

Final Thoughts

Presently, the market is in a risk-off mood. Whether it is a Bitcoin, microchip, or silver, if it is an investment, it is largely sold to recover the losses. The easy money age of post ETF rally has officially hit a harsh wall of reality.