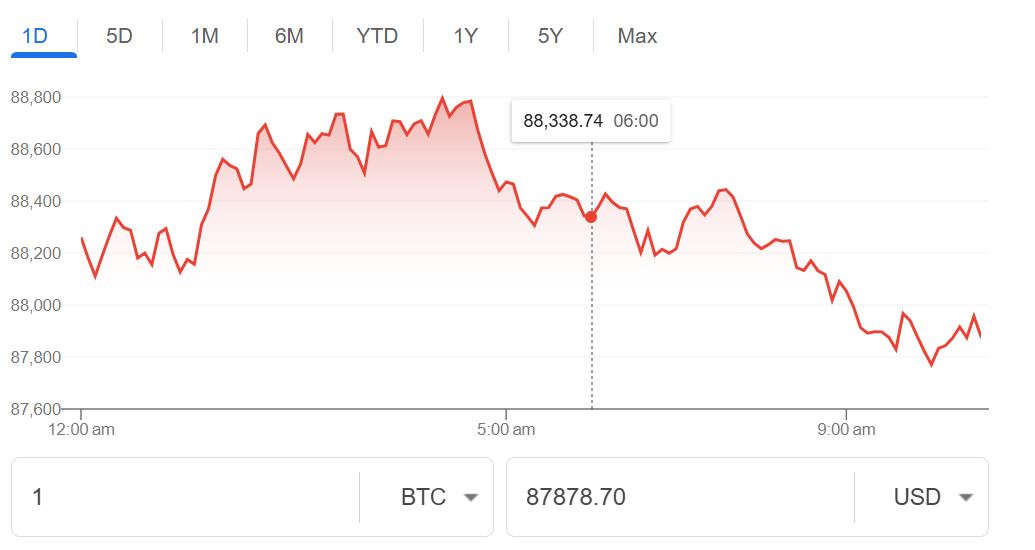

The Bitcoin price has dropped to $74,546, a nine-month low. The Bitcoin’s negative cycle has probably initiated due to massive crypto liquidation and a decrease in the prices of precious metals, rattling global markets.

The data available at Crypto. News indicates that the price of Bitcoin dropped by 5.7% to an intraday low of $74,546 on February 2nd. This latest decrease has brought the bellwether asset down to its lowest level since April of the previous year.

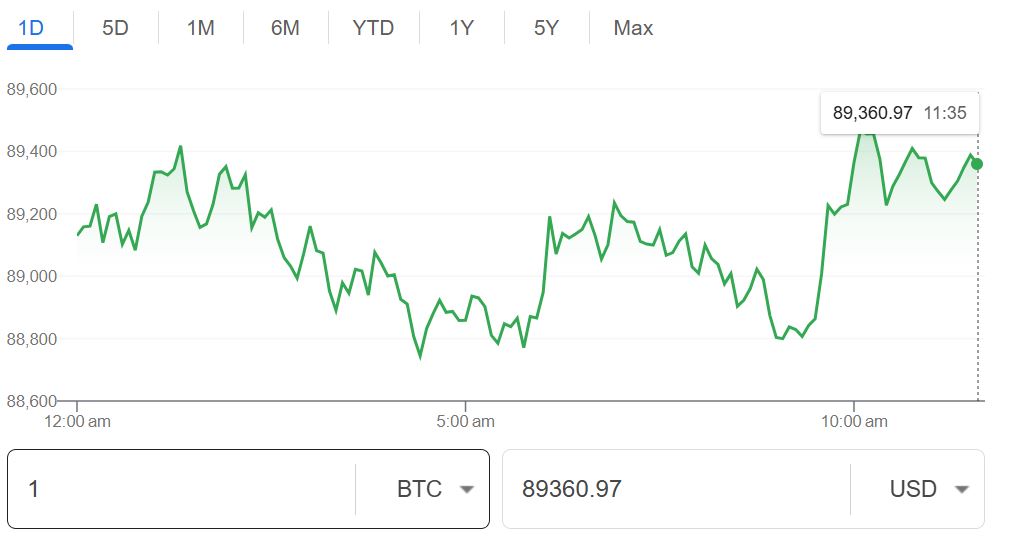

In the broader context, the downward trend started on Thursday after its price lost the psychological support level of $90,000. It has since decreased 17% while increasing its total losses to 40% from its peak this year.

The bitcoin price is showing downward trends due to a confluence of sharp deleveraging across positions and a sharp sell-off in precious metals. This is forcing investors and traders to sell other assets to recover their losses.

The data from CoinGlass indicates that the crypto market has experienced a huge liquidation worth of $788 million. Most of this wipe-out is attributed to highly leveraged bullish bets. Since Bitcoin alone stood at over $200 million of those long liquidations.

Liquidation generally occurs when a broker or exchange is pressurized to close a trader’s position due to market moves against then and they no longer possess enough margin to cover the risks.

A majority of market collapses due to long positions occurs when an asset’s price experiences an unexpected and sudden drop. Exchanges are compelled to close these bets, which consequently instigates a liquidity cascade that could continuously affect the prices.

Initially, this series of liquidations occurred during the weekend when more than $2.4 billion across bullish positions were melted down. As a result of this, an environment of fear and uncertainty is created that drives traders away from the market.

Read: Stock Futures Slide as Bitcoin Drop Rattles Global Markets

The sell-off was further aggravated by the meltdown of precious metals. A sharp decline in gold and silver prices forced the majority of traders to liquidate their Bitcoin holdings to recover losses against these precious metals.

Trader’s interest in risky assets also suffered a serious jolt due to President Donald Trump’s recent nomination of Kevin Warsh as the new Chair of the Federal Reserve. Investors believe that the new chair will significantly shrink the Federal Reserve’s balance sheet and constrict liquidity, reducing the easy money environment that facilitates speculative assets like Bitcoin.

In the meantime, unlike prior dips, Bitcoin’s sharp sell-off this time was defined by a significant absence of buyers. Institutional interest in the legacy crypto assets has also cooled down with spot Bitcoin ETFs recording at$1.6 billion in net outflows in January.

Considering the technical perspective, Bitcoin did not have a support level during the previous week. Specifically, the recent $80,000 mark, which acted as a fundamental psychological support area in the past.

Trader sentiment has also become gradually fragile as the majority of them pay close attention to round numbers in prices like 4800 or 50000. However, when prices decrease below these levels, investors usually believe that sellers are now in control. If this occurs with heavy trading, fear spreads rapidly. In this situation, people rush to sell, and traders borrowing money are also forced to close their position, driving the price even faster.