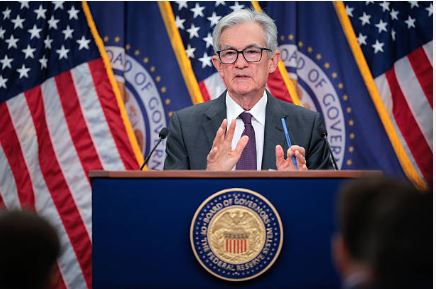

The US Federal Reserves did not change the interest after setting the rate in the first meeting of the year despite huge pressure for the White House to decrease the rates.

Currently, the interest rate is at a range of 3.5-3.7% as the majority of the members in the Fed’s Open Market Committee(FOMC) voted to hold the interest rate cuts after reducing the rates three times in a row in the fall.

The Trump administration has placed immense pressure on Fed’s Chair to reduce rates by debuting personal attacks on Powel and the Justice department via opening a criminal investigation on his management of Central Bank’s offices’ refurbishment.

The FOMC possess 12 voting members and this meeting occurs eight times in a year to decide interest rates. Each FOMC meeting’s stakes have been elevated throughout President Donald Trump’s second term as president. While many economists believe it is this independence that contributes greatly to our overall economic stability, Trump has made it quite obvious that his desire is for the FOMC to conform to his unique economic philosophy and flexibility.

Cutting the interest rates can encourage only short-term economic activity at the risk of elevating the prices in the long-term. However, Trump has claimed that Fed’s decision of holding the similar interest rates would be devastating to the US economy by costing hundreds of billion dollars.

But Fed’s officials have resisted these claims. In December at the last FOMC meeting, Powell implied that the Fed would pause rate cuts for now: “We are in a good position to wait and see how the economy develops.” After the meeting, Trump described Powell as “crazy” and stated that the rate decrease “could have been double.”

The depth of Trump’s frustration with Powell didn’t fully materialize until January 11, when he announced that Powell would be under criminal investigation and that he would no longer serve as Chair of the Federal Reserve (he currently holds his seat until May).

The criminal investigation is centered around Powell’s summer congressional testimony regarding the excess expenditures for renovations at the Federal Reserve Building. Trump accuses Powell of fraud; however, Powell has stated that the renovations were needed for safety improvements in buildings that have been in existence for multiple decades.

Read: Tom Lee Warns Investors Not to Overlook Ethereum as Metals Rally

Powell classified this investigation as “pretext” and argued that current interest rates are at neutral level which suggest that no cuts will be expected soon. He further added that he and his colleagues it is a difficult task to interpret the incoming data and conclude that policy is largely restrictive at this time.

In the ongoing criminal investigation, which received heavy backlash from Republican lawmakers and business leaders, Fed did not answer to multiple questions. He declined to comment on whether he will be on Fed’s board after stepping down as Chair. Powell’s term on the board would be expired in 2028.

However, Powell stated that he is a firm believer of Fed independence and significance of preserving Fed’s credibility. Monetary policy can be employed via an election cycle to influence the economy that is politically significant. But he cautioned that having an autonomous Central Bank is a good practice, and if its lost then it would be difficult to regain the credibility of the institution.