Big Stocks at Cheapest These Months

The current situation in the market has resulted in large price reductions on firms such as Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). While there have been some investors that do not believe that there will be further declines in the near future based on trends we have seen previously, this week the Magnificent Seven collective (Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN), Meta (META), and Tesla (TSLA)) saw its lowest price/earnings (P/E) ratio since the S&P500 hit the previous peak of October 2021, reaching 10%.

While the current P/E ratio of the Magnificent Seven collective is much more than it was in December 2018 (when companies faced increased headwinds in their earnings and operating performance), there is still a much greater degree of uncertainty in terms of where the bottom will be in 2023.

According to Violeta Todorova (Senior Research Analyst with Leverage Shares), “Valuation ratios of the Magnificent Seven have definitely gotten better versus where they were back in December, but I don’t think we have yet hit the bottom”. Violeta also mentioned, “While I would love to be buying these lower-value stocks now, I just don’t have that level of certainty. There are too many unknowns out there right now, and I believe we will be in worse shape before we can recover.”

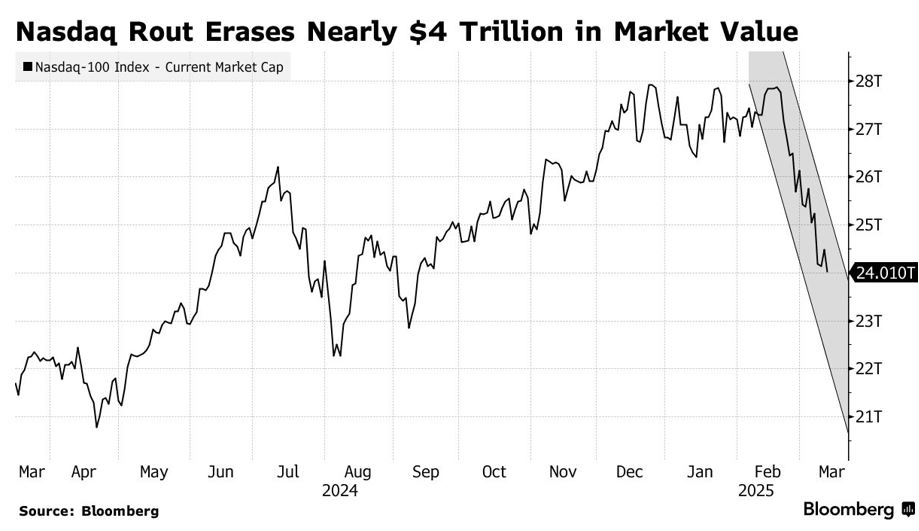

Market Trends and NQSDAQ Performance

As per Bloomberg data, during the past 12 months, the P/E ratio for the Magnificent Seven collective has been 26 times the expected earnings for the next 12 months, versus a P/E ratio of approximately 19 times the expected earnings for each of the last two bottoms of the market (in December 2018 and in December 2021).

After an encouraging gain on Friday, the tech-heavy Nasdaq 100 stock index has had an overall drop of 2.5% for the week and is now down 11% from its all-time high set in February of this year. The biggest portion of this index, Apple, had its largest weekly decline in over two years. This is quite a change from the situation just a month ago, when many large technology companies (like Alphabet or Amazon) were at record levels because investors were buying large amounts of their stocks based on the assumption that President Trump would make policies that would encourage economic growth and would relieve technology companies from regulatory burdens.

The views of the Trump Administration and the other representatives in government have changed dramatically; they have made it clear that they are willing to tolerate large stock price declines and short-term economic hardship to reach their long-term goals of dramatically restructuring the U.S. economy. Consequently, investors are now scaling down their investment in risky assets, particularly technology stocks that have outperformed the most during this current period of bullishness (which began in October 2022) in U.S. stocks.

Read: European Stocks Surge Higher after Trump Rows Back on Tariff Threats

For almost ten years, investors have seen time and time again how rewarding it can be to purchase technology stocks after seeing their prices decline. The prolonged price declines of equity indexes, such as the 33% drop in the Nasdaq 100 during 2022, were ultimately great buying opportunities as companies like Meta Platforms went on to achieve new record highs in the next two calendar years after that drop. The overwhelming consensus is that the technology sector houses the highest quality businesses in the world, mainly because of their market share, very high profit margins, and enormous growth potential.

Long-Term Investment Outlook

Whether the aforementioned advantages are already factored into share prices, and if they could all be jeopardised with a downturn of economic activity, and if these “big bets” placed in the Artificial Intelligence (AI) sector will fail to yield the hoped-for results. Since the Nasdaq 100 established its highest-ever closing figure 17 trading days ago, the index has responded (up) six times during this time, but none of these gains have been sustained thus far.

Wall Street analysts have also reduced their 2025 projections for the Magnificent Seven, even though the group produced exceeding expected earnings growth for Q4 of 2021 on average. The total profit growth for the cohort has been reduced to 22% vs. 24% initially projected back on January 15, 2022, based on information from Bloomberg Intelligence. Collectively, this group delivered earnings growth of 34% in 2022. The contributions to this value will only be less than the overall size of the index. The S&P 500 is projecting total profit growth of 12% for 2023, compared to 10% in 2022.

The Magnificent Seven companies cater to a diverse array of customers across virtually all sectors and industries. Each company of the Magnificent Seven has a unique profile. Tesla, for example, is the outlier in this group as it is the smallest company in terms of size, the tightest margin in terms of profit, and has the largest multiple in terms of relative valuation due to the fervent following of its CEO, Elon Musk. Despite experiencing a near 48% decrease in stock price (over the last three months), the stock currently trades at 82X the projected profit.

The second most expensive company will be Apple, which trades at a much lower multiplier than Tesla at 29X its forward earnings. Will Alphabet, the least expensive company in this group, trade at a multiplier of only 18X? Alphabet, however, still trades at multiples that traditionally have been at the peak of their valuation in 2022.

While there is evidence to support the Bulls’ arguments, there were several things that the Bulls used to support their arguments on the Mag 7 index. For example, a 14-day Relative Strength Index (RSI) is a measure of momentum versus valuation; the index has recently dropped below 24, its lowest level since 2019, indicating an oversold status.

Conversely, the RSI has since recovered to 36 and is far below 70, which indicates an overbought security. Further, Todorova feels strongly that the fundamentals for many of the stocks within the group remain intact and that investors will ultimately return to the group after the current sell-off; “Bullish fundamentals remain in place even with the current sell-off, and it is only a matter of time until the majority of investors come back to the large-cap technology stocks,” said Todorova. “

Final Thoughts

In my opinion, it is less about the fundamentals of these companies and more about the macroeconomic and geopolitical environment. During the next quarter, we will receive additional clarity on the future path of Federal Reserve policy and how growth will evolve, and if we start to see the market recover, then I believe we will see large-cap technology stocks outperform.”