The Chief Economist of the European Central Bank (ECB), Philip Lane, recently made a statement that political forces in the U.S. could negatively impact the position of the dollar as the world’s dominant reserve currency. If there is a loss of confidence in traditional monetary policy, Bitcoin could function as an alternate form of currency. If the FOMC’s independence were to be disrupted because of a political conflict, the market’s perception of U.S. government bonds and the dollar could change. Under these conditions, investors may begin evaluating the “risk” associated with owning U.S. government bonds, and as such, they may make changes to their investment portfolios.

One way in which these changes could occur is through an increase in demand for longer-term Treasury securities and other investment instruments at a premium price. If the Fed’s independence is threatened, the market may respond with an expectation that there will be higher-term premiums for longer-term bonds. Therefore, investors should expect that longer-term bond yields will increase even if the Fed does not raise its target rates. As the long-term yields rise, financial market conditions are expected to tighten, thus negatively impacting stocks, bonds, and higher-risk classes of assets.

The dollar has served as the distinguished reserve currency for many years, and remains the dominant reserve currency of the world because of the size and strength of the U.S. economy, but if investors lose confidence in U.S. monetary policy, the possibility exists that the dollar’s preeminence as the world’s reserve currency will be reassessed, potentially resulting in a depreciation of the dollar. This scenario is likely to occur if political considerations outweigh economic fundamentals.

In this situation, the analysts and traders are increasingly discussing Bitcoin as a potential “escape valve” during periods of monetary distress. They argue that if traditional assets lose their attractiveness because of either political or institutional risk, then some investors are likely to seek out Crypto Assets as viable alternatives for protecting their wealth/value or hedging against potential declines in purchasing power associated with fiat currencies.

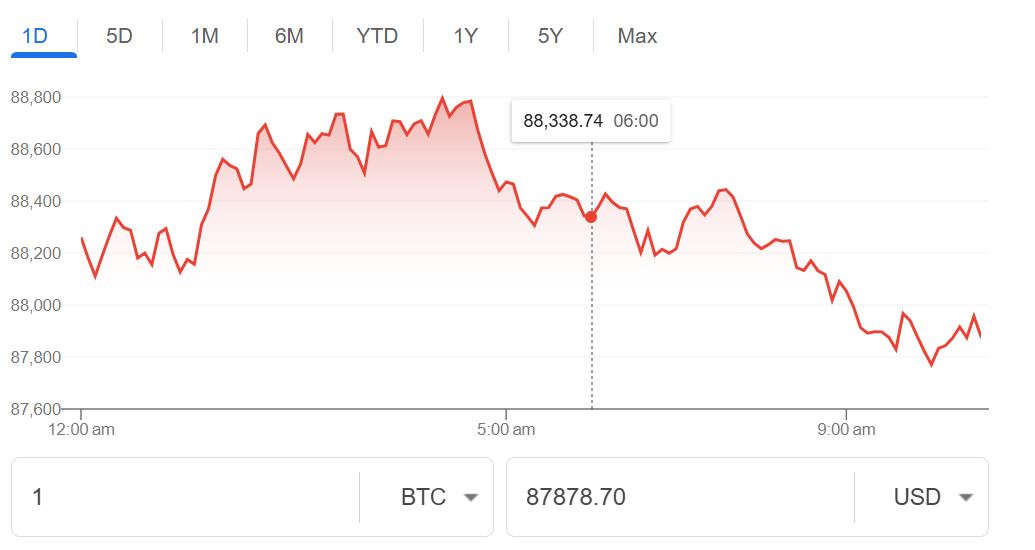

Bitcoin, like many other financial products, has a pricing structure influenced by “discount rates, “liquid conditions,” and “market participant sentiment”. When yields are low in real terms and liquidity is high, Bitcoin and other risk-based investments are likely to perform well. If term premiums increase and liquidity decreases, it may restrict the financial conditions for Bitcoin and all risk-based investments.

On the other hand, if investors lose faith in the traditional monetary system (for example, if investors become politically wary of the Fed, leading to higher term premiums), some of those investors may begin moving part of their portfolios into Crypto Assets, including Bitcoin. If this were to occur, it could potentially weaken the dollar and create increased demand for alternative monetary assets. However, this ultimately depends upon overall market conditions.

A further discussion point related to this topic is the stablecoin market, which is essentially digital tokens created to maintain a stable market value and is backed by various assets (like U.S. Treasuries). A shock to either term premiums or liquid conditions can be impactful for the stablecoin market, as it relies heavily upon the same dynamics of safe assets. If there are any liquidity changes in the stablecoin market, it will also likely create an impact on Bitcoin and other competing forms of Crypto Assets in terms of trading and liquidity.

At this point, investors don’t anticipate changes in interest rates by the Federal Reserve (Fed) in the near term, so investors do expect stability in the near term regarding term premiums on bonds. However, the ECB has highlighted the potential serious problem of losing confidence in central banks. Political pressures could create sudden changes in the financial markets that would make alternative currencies such as Bitcoin attractive to some investors, especially in the face of uncertainty surrounding the US dollar.