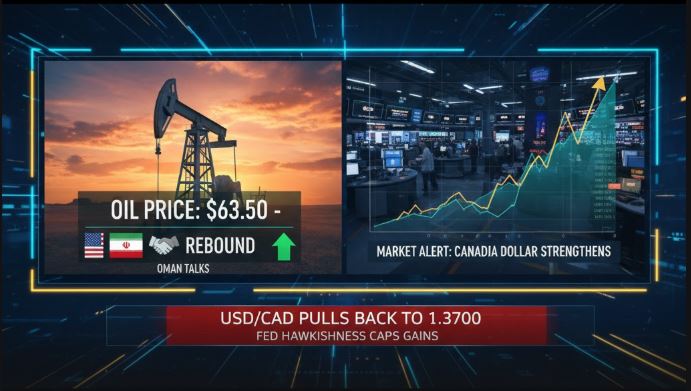

The Canadian Dollar, often known as the Loonie, is strengthening this Friday. The USD/CAD exchange rate has pulled back to 1.3700 as oil prices, the lifeline of the Canadian economy, start recovering. As the oil prices rise, the Canadian Dollar follows a similar trend. When Canada is cheering up, there are some important strategic moves within the Middle East, and the US is leaving investors anxious.

Peace Talks in Oman

Oil prices have bounced back to $63.60; however, the rally might not go a long way. This is because the US and Iran have decided to negotiate in Oman today. The purpose of the talks is to find a mutual ground on long-running nuclear disputes and regional tensions.

If the negotiations go well, the fear factor rising the oil prices will vanish, and it could cap the further gains for the Canadian Dollar.

US Dollar Still Staying Strong

Regardless of small gains in the Canadian Dollar, it is important to note that the US Dollar has not been performing badly, as it is currently estimated at a two-week high due to the Federal Reserve’s signals about no cuts in interest rates in the near future.

These signals are reinforced by the following key updates from the Fed:

1. Fed’s Governor, Lisa Cook, has stated clearly that she would not encourage further decreases in the interest rates as she believes that inflation is currently dead.

2. The nomination of Kevin Warsh as the next Chair of the Fed has made investors believe that the decrease in interest rates will be slight and steady rather than following an aggressive trend.

Read: Oil Prices Bounce Back: Why the US-Iran “Tension” is Moving the Needle

What Comes Next for Traders?

Although the job market in the US is exhibiting the signs of melting down, allowing most investors to believe that interest rates might be reduced in June and September, the US dollar remains a safe-haven.

Final Thoughts

Thus, currently, CAD is increasing due to an increase in oil prices. However, if the US does not reduce the interest rates and geopolitical tensions with Iran settle down, then the USD/UCAD pair would further climb up.