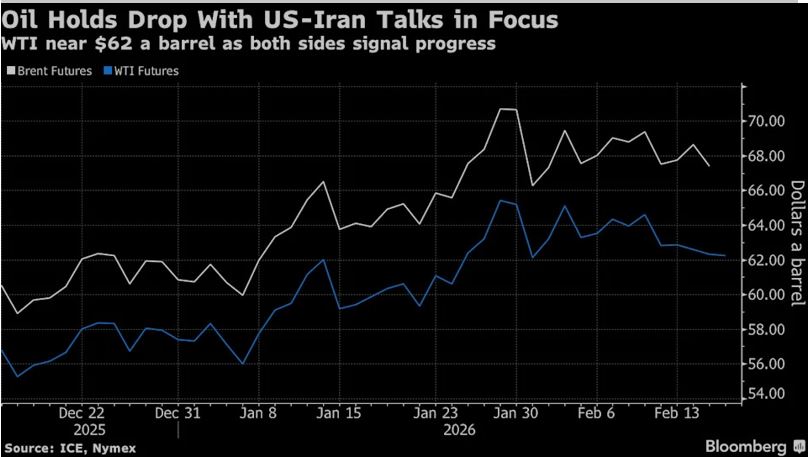

Oil prices held a drop as US-Iran Nuclear talks gave positive signals from both sides. Brent Brent was lowered by 2% to $67 per barrel, and WTI was near $62 per barrel

Bloomberg – Oil held a drop after positive talks between the US and Iran over the OPEC member’s nuclear program, cutting crude’s risk premium.

Global benchmark Brent was lowered by 2% on Tuesday to $67 per barrel while West Texas Intermediate stood near $62 per barrel.

Tehran has claimed to have reached a “broad consensus” with Washington involving the terms and requirements of a prospective settlement. While an official in the U.S. stated that the Iranian negotiators will be back in Geneva in the next two weeks with new proposals.

Geopolitical factors are pushing crude prices higher this year, despite warnings by traders and analysts that a glut of oil in the global market could pull prices down.

The recent anti-government riots and protests in Iran have further heightened traders’ anxiety regarding the possibility of military confrontation resulting in interruptions in oil production or disruption of the critical transportation route (the Strait of Hormuz)

JD Vance, U.S. Vice President, commented on Tuesday that the “talks” between Iran and the U.S. have been productive, but Iran has not yet recognized President Trump’s “Red Lines.” The apparent diplomatic progress occurred despite the rising geopolitical tension

Iran announced on Tuesday that it would temporarily block part of the Strait of Hormuz, the world’s main shipping route for oil and gas exports from the Persian Gulf.

The United States has also been increasing its military presence in the region by sending its second aircraft carrier to the deployable area of Iran.

Read: US Futures Steady with AI Fears in Focus Ahead of Fed

Meanwhile, investors across the globe are tracking US-brokered mediated peace talks between Russia and Ukraine. As one of its lead negotiators indicated, the negotiations would continue on Wednesday.

If a peace agreement is reached between both countries, the international economic embargoes that have been imposed on Russia will likely be lifted, and create an increase in crude oil volumes to the global markets within a short period of time (11-90) days post-conclusion of negotiations.

On Wednesday, Asia is expected to have lower trading volumes than normal due to many Asian countries being closed for outward celebrations for the Lunar New Year, including Singapore, the largest trading center for oil, and China, the largest oil-consuming country in the world.