A desperate pivot, not just an increase for the budget, has the financial community wondering if the cost (especially human and financial) associated with the revolution in AI will be worth it!

The US stock futures showed a sharp decline on Friday, topping a few of the previous session’s increasing losses, even with Amazon shares dropping after anticipating a huge capital expenditure for 2026.

On the other hand, Dow Jones Futures increased by 130 points, S&P 500 Futures increased by 28 points, and NASDAQ 100 was lifted by 135 points. However, the major Wall Street indices exhibited a sharp decline on Thursday, with the NASDAQ Composite showing a decline of 1.6%, the broad-based S&P 500 fell by 1.2%, and the blue-chip Dow Jones Industrial Average rose by 500 points.

So, Wall Street experienced a new tug of war on this Friday. As the stock futures are struggling to keep pace on the stage after a brutal performance on Thursday, the big tech companies are feeling the heat of their huge expenditures.

The AI Race

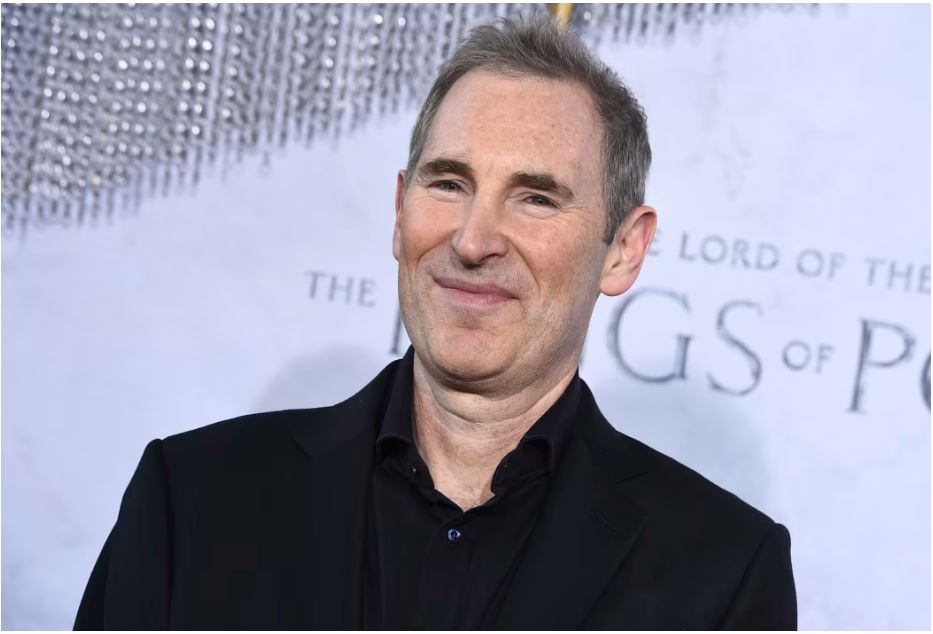

The largest shock came from Amazon when the tech giant declared its future plans of spending an astounding amount of $200 billion in 2026. The majority of this amount will be dedicated to cloud infrastructure(AWS) and AI.

Though Amazon is growing, investors are getting anxious and asking when this investment will give returns. It is due to this AI Fatigue that tech stocks have witnessed a severe week since April.

The total big tech spending for 2026 is estimated at around $630 billion from giants including Amazon, Microsoft, Google, and Meta.

Read: Trump’s New Love Affair: Why the Weak Dollar & $5,500 Gold are the New Normal

A Recession Era for the Job Market

Although the stock market is bouncing, the real-world economy is exhibiting some cracks. The new data indicate that downsizing in January 2026 has reached the highest level since the 2009 Great Recession.

The estimates indicate that around 108,000 jobs were cut in January, which doubled compared to the previous year. The major contributors to job cuts are UPS and Amazon, as they downsized around 30,000 and 16,000 jobs.

All eyes are now watching the University of Michigan Consumer Sentiment data, which is due later today. Since this data will inform whether Americans are about to close their wallets in response to new jobs.

Oman Peace Talks & Oil Prices

Oil prices increased on Friday but were still heading for their first weekly decline in nearly two months as investors are increasingly focused on the results of US-Iran talks expected later in the day.

Traders are expecting that these talks will avert the war in the Middle East, which has dropped risk premiums. Both WTI and Brent crude are on the track for their first weekly loss in two months.

Final Thoughts

The market is thus currently tied between two worlds: the economic present (where the jobs are being cut) and the AI future (which costs a fortune to develop). It is expected that the rollercoaster will continue until clearer results from AI or more stable job data are obtained.