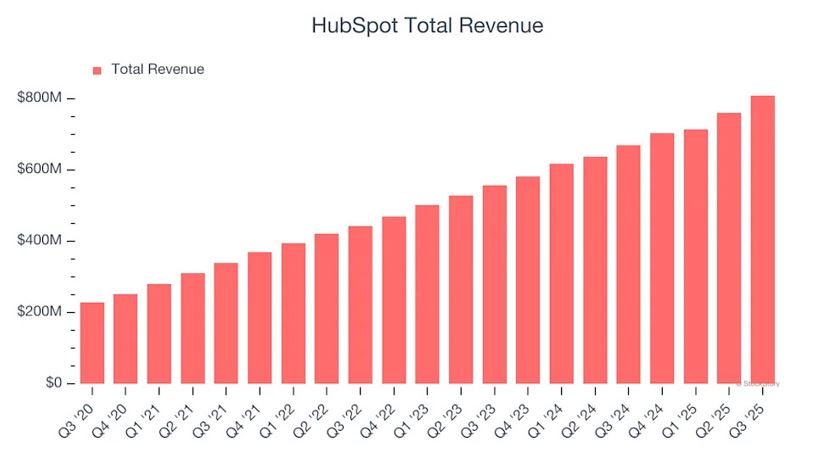

YahooFinance reports that Customer platform provider HubSpot (NYSE: HUBS) will report its financial results this Wednesday after the close of the stock market. This is what you can expect to happen. During the last quarter, HubSpot beat analysts’ estimates for revenue by three percent when it generated $809.5 million in revenue, an increase of 20.9% over the previous year. HubSpot had a very good quarter, having exceeded analysts’ projections for EBITDA as well as providing guidance for full-year EPS slightly above analysts’ estimates. During the last quarter, HubSpot added 10,898 new customers, bringing its total to 278,880.

For this quarter, analysts expect HubSpot’s revenue to increase 18% over the prior year to $829.9 million, which is a decrease compared to last year’s 20.8% increase during the same quarter. Analysts expect HubSpot’s adjusted earnings to be $2.99 per share.

Over the last thirty days, analysts covering the stock have mostly reiterated their estimates, which implies that they expect the company to continue to perform to their projections heading into earnings. HubSpot has a strong history of exceeding Wall Street expectations, having outperformed revenue forecasts on average by 3.3% each quarter for the last two years.

While HubSpot has reported no quarter results for Q4 yet, we can get some insight into Q4 business models from its peers in the sales and marketing software sector that have reported Q4 results. For example, ZoomInfo reported year-over-year revenue growth of 3.2%, beating analyst estimates by 3.2%. Similarly, LiveRamp’s total revenue grew 8.6%, marking an accurate forecast from analyst consensus. After the release of its quarterly earnings, LiveRamp’s stock increased 3.5%.

The excitement that came from Trump winning in November caused stocks to soar; however, the upcoming tariffs have seen the markets correct by 180 degrees in 2025. Unfortunately for the sales and marketing software public companies, the last month was a tough one, and their average stock price has dropped 17.9%. HubSpot’s price has fallen by 38.5% in that same period and is about to report earnings with an average analyst target of $519.60 (the current price is $231.20).