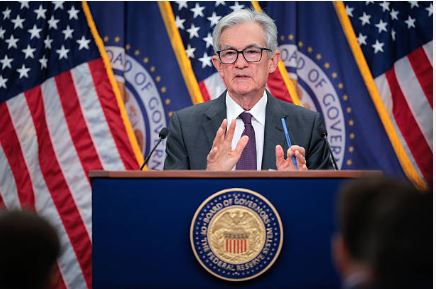

The minutes of the Fed’s meeting released yesterday give a Hawkish look. unlikely to move aggressively towards a policy of easing due to their lack of confidence at this time. Core inflation remains close to 3%

The minutes of the Fed’s meeting were released yesterday and are considered more hawkish than the expectations.

The majority of participants encouraged keeping the interest rates unchanged, as they were of the view that the current rates of 3.50-3.75% rate is within the range of a neutral level.

At the same time, a notable number of participants also indicated that additional cuts in the interest rates may not be adequate unless disinflation is confirmed and is back on track.

Considering that PCE inflation, the data the Fed uses to track inflationary pressures, is currently running near 3%, which is greater than the Fed’s target of 2%

A very interesting part of the minutes was the number of participants who also indicated they would have preferred to have had a two-sided statement regarding the Committee’s decision about future short-term interest rates.

This would indicate that many Fed participants feel there is a possibility that prices will remain high enough that policy tightening will not be ruled out. Despite the fact that most participants expressed a belief that future progress towards the Fed’s target of achieving 2% inflation would take longer than expected, it was reiterated that the economic growth in this economy is currently in a solid upward trend.

Read: Global Stocks Mixed as Asian Shares Gain, and Wall Street Rallies on Nvidia

Overall, the minutes would be considered to be supportive of the USD and stressed that the Fed is currently in a wait-and-see mode. However, the USD will face continued weakness due to the potential for an even larger easing cycle planned by the Fed relative to that of central banks operating in other parts of the world, as well as due to the continued deterioration of the US labour market and the urgent demand for speedier easing.

The minutes from the Federal Reserve’s meeting indicate that they are unlikely to move aggressively towards a policy of easing due to their lack of confidence at this time. Although inflation has decreased from its prior highs, core inflation remains close to 3%.

This indicates that the risks to price stability have more work to do before fully resolving. The language used in the minutes indicates that future decisions will depend largely on how future data on inflation and Labour markets develops rather than what the Fed has predetermined about how many interest rate cuts it will make in the future.

This could signal to financial markets that any rate cuts which may occur, if they occur, will likely be slow and limited rather than fast and large.

Finally, the discussion related to implementing a two-sided policy approach demonstrates the Committee is cautious about the Edging Out of Economic Growth and the possibility of experiencing a resurgence of inflationary pressures over the medium-term.