Gold(XAU/USD) has traded flat on Thursday. The recent data has revealed that it is currently trading at approximately at $4,975 and is experiencing a consolidation phase

Gold (XAU/USD) has traded flat on Thursday, striving to extend the gains secured yesterday as traders weigh hawkish Federal Reserve Meeting Minutes against continuing geopolitical tensions.

Currently, XAU/USD is trading at approximately $4,975 and is experiencing a consolidation phase after an intraday peak of approximately $5,021. The US dollar’s recent increase due to positive US economic releases has put some mild downward pressure on XAU/USD.

The initial jobless claims figure from the week ending February 14th came in at 206K versus the forecast of 225K and was also lower than the previous figure of 229K. Additionally, the Philadelphia Fed Manufacturing Index rose to 16.3 in February from a prior value of 12.6 in January and also beat consensus estimates of 8.5.

Fed’s Meeting Minutes

The recent Federal Open Market Committee’s (FOMC) January meeting published yesterday, has struck a hawkish tone. The policymakers are also observed to be divided on the monetary policy path.

The majority of the participants suggested that it is better to keep the interest rate steady for some time while evaluating incoming data. At the same time, officials are also open to future rate increases if inflation is observed above the target.

On the other hand, some other members noted that rate cuts would be adequate lately if inflation decreases according to their expectations.

The minutes thus reemphasized the view that near-term cuts in interest rates are unlikely. This prevailing condition supports the US dollar and Treasury yields and pressures non-yielding metals.

Even then, markets expect the Fed to recommence its monetary policy easing in the second half of the year.

Read: Hawkish Fed Minutes as Markets Work to Find Their Footing

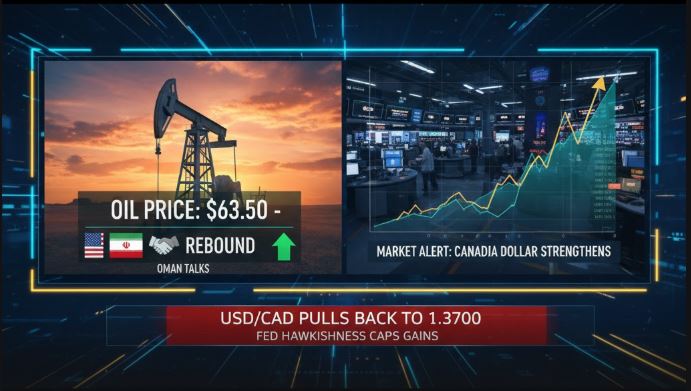

US Military Action Against Iran

Despite a high-level dialogue earlier this week, geopolitical risks related to the elevated US-Iranian tensions have continued to remain high. CBS News reported earlier this Thursday that US military officials have indicated that they will conduct potential airstrikes against Iran this upcoming Saturday.

Over the last several days, there has also been a considerable increase in US military assets in the region. Once again, as seen the previous week, US President Donald Trump has made a final decision regarding the escalation of military forces to the region.

With this backdrop in mind, the overall trend of gold prices continues to be higher. It appears that a retracement of prices will draw buying interest to enter the market, and at the same time, will continue to be represented by continued price support due to consistent demand from institutional-type investors entering into the Gold market.

Looking ahead, the economic calendar for economic data in the U.S. will be relatively light; however, market participants are fully focused on Friday’s economic releases, such as the Core Personal Consumption Expenditures (PCE) Price Index and the preliminary estimate of Q4 Gross Domestic Product (GDP) in the US.