Dollars held gains on Tuesday as the market awaits minutes of the Fed’s meeting later this week, which will give the timing of rate cuts. The yen strengthened by 0.3%, and the Australian dollar fell by 0.1%

Reuters- Dollars held gains on Tuesday as the market is waiting for the minutes of the Fed’s meeting later this week, which will give the timing of rate cuts.

The Yen decreased losses from a day earlier, when the weak Japanese economic data stirred all expectations from the government to boost the economy. The Aussie dollar edged lower after the minutes released from the Reserve Bank of Australia, indicating that policymakers are not interested in increasing the rates in the near future.

The trading volume was low in the majority of Asian markets due to the closure for the Lunar New Year Holidays and the President’s Day holiday in the US. The key economic events are scheduled later this week, including minutes from the Fed’s meeting and advance figures on US Gross Domestic Product(GDP).

Kristine Clifton, senior currency strategist at Commonwealth Bank of Australia in Sydney, stated that they are quite optimistic about the US economy. She further added that the majority of markets are expecting a cut in interest rates in June. Contrarily, they expect a follow-up cut in July. She was of the view that in 2026 the most significant driver for US Dollar steady position will be the narrative of US exceptionalism.

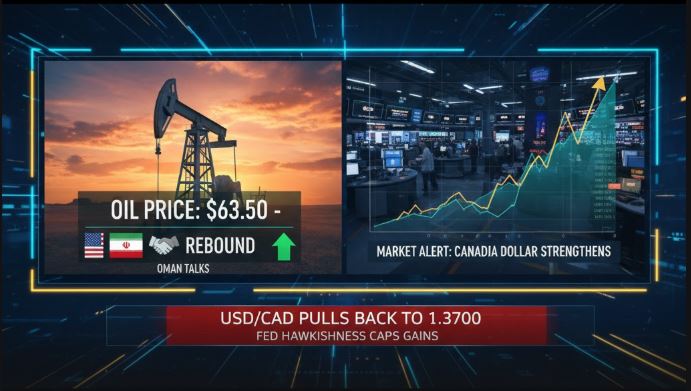

The dollar index, responsible for estimating the greenback against the basket of currencies, climbed up to 97.12after recording a gain of 0.2% in the previous session. The euro fell by 0.1% to $1.184.

On the other hand, the yen strengthened by 0.3% to 153.05 per dollar, and the sterling weakened by 0.11% to $1.3607.

The US inflation data released on Friday indicated that US consumer prices did not exceed in January according to the expectations, considering the Fed’s additional leeway or policy easing this year. Money market traders are pricing about 59 basis points of easing for the rest of this year.

Read: Stocks and Bonds Struggle for Direction After Soft Inflation

On Wednesday, the FOMC will release its minutes from the January meeting. This week will also include several other economic indicators that will be released, including CPI data for Great Britain, Canada, and Japan, along with preliminary global PMIs on Friday.

On Monday, a rally in the yen was halted after the release of growth data for Japan’s economy for the last quarter, which showed only a slight increase. The yen has lost nearly four percent against the dollar since last year when fiscal dove Sanae Takaichi took over as the Prime Minister of Japan.

Bart Wakabayashi, branch manager of State Street in Tokyo, noted that with the huge amount of money entering Japan’s booming stock market, things are starting to change direction for the yen. There has been a reduced overweight position in dollar-yen by the institutional money managers, and they are now buying yen and selling dollars.

The Australian dollar fell 0.1 percent against the US dollar to $0.706, while the Kiwi remained relatively unchanged at $0.6029 ahead of the Reserve Bank of New Zealand’s meeting to set the cash rate tomorrow, where it is expected to remain unchanged.

The minutes of the RBA’s last policy meeting indicated that the board was not sure about whether further hikes would be required, but revealed that inflation had already been above the target for three years.

In cryptocurrencies, Bitcoin dropped by 0.68% to $68,377.70 while Ethereum fell by 0.68% to $1,985.32