Bitcoin is flashing signals about a major turning point in its previous cycles; however, there is no indication of a durable bottom, Experts says

DeCrypt- Bitcoin is giving signals that are defining the major points in the previous cycles; however, these signals do not indicate a durable bottom.

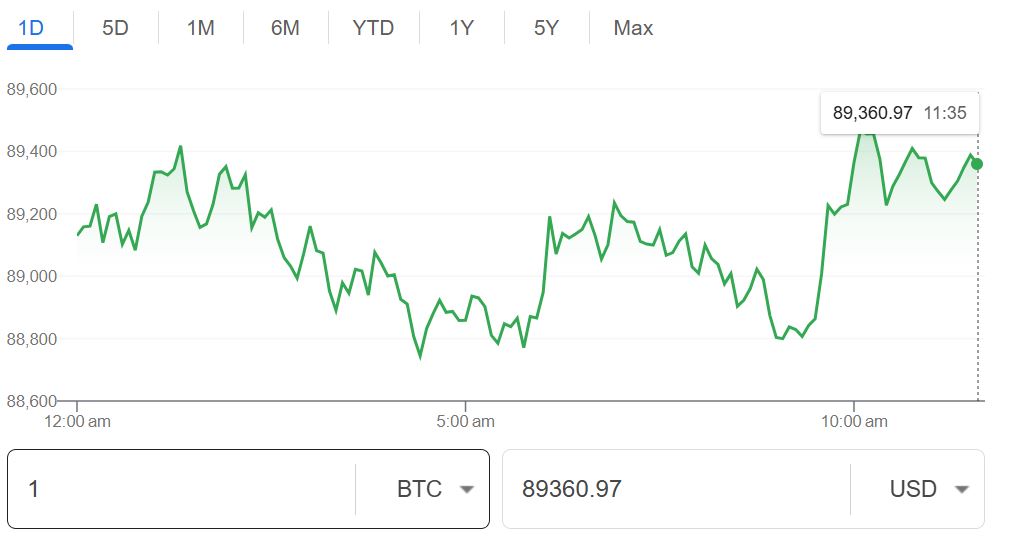

The multiple on-chain indicators tracked by CryptoQuant indicate that the market is stuck between a mid-cycle correction and a deeper rest, even when investors are considering the current Bitcoin price as the worst one.

All indicators, including Long-Term Holder(LTH) capitulation, Market Value to Realized Value(MVRV), Net Unrealized Profit/Loss(NUPL), and the percentage of supply in profit, are presently in no man’s land, which is a position between mid-cycle correction and a total market reset.

According to a report released on Thursday, CryptoQuant stated that historically, bear market bottoms have occurred during periods where 30-40% margin losses have taken place among Long-Term Holders (LTH). LTH profit margins have declined from 142% in October to breakeven levels, but analysts believe that true capitulation is still a way off.

Ryan Lee (chief analyst at Bitget) stated that he broadly agrees that the market may not have yet created a macro bottom. Liquidity remains constricted, and risk assets tend to respond to macro-economic data; therefore, there could be a final washout if the equities continue to weaken.

As for the MVRV Z-score, it has yet to enter an oversold range of -0.4 and -0.7, where historically market bottoms have formed. NUPL currently is approximately 0.1, although market bottoms typically develop when holders have approximately 20% unrealized losses.

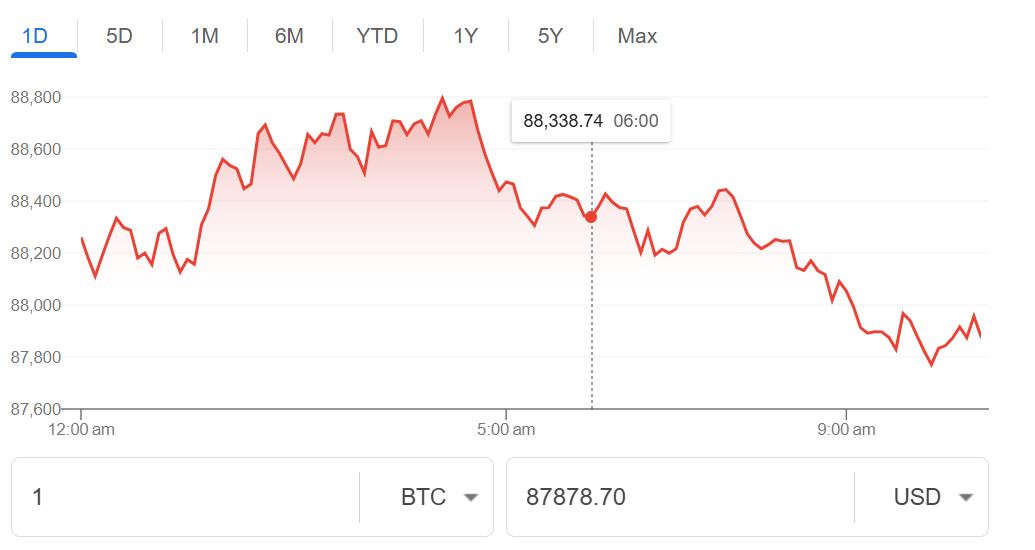

Goldman Sachs and Standard Chartered, two traditional financial institutions, have followed a bearish view of Bitcoin, according to Decrypt. They project Bitcoin could fall to between $50,000 – $58,000 soon.

After the hotter job reports, the traders are watching January inflation data that is to be released this Friday, delayed due to the partial government shutdown. If headline inflation rises by surprise, there will likely be a longer period of high interest rates, causing further downward pressure on all risk assets, including Bitcoin.

Bitcoin investors are currently navigating extreme uncertain macro environment. The confusing signals have left the market to search for direction regarding the Bitcoin price. Some analysts, however, believe Bitcoin will bounce back.

According to Sean McNulty, the APAC Derivatives Trading Lead at FalconX, “On February 11th, the Crypto Fear and Greed Index dropped to an extreme low reading of 11/100, highlighting extreme fear and potential for a lot of sellers to be exhausted”.

In contrast to the crypto market collapse of 2022, this current downturn has been caused by a lack of liquidity and macroeconomic changes, but without any major, widespread failure of an industry like in 2022 when FTX went bankrupt.

“Because we did not see a catastrophic blow-up, the crypto market may be experiencing standard (though painful) institutional deleveraging instead of a truly terminal breakdown,” said McNulty.

Read: US Stock Futures Slip Slightly ahead of Key Inflation Data Release

Additionally, McNulty referred to last week’s price movements in Bitcoin as additional evidence of a floor forming, with the price dropping to a psychological support level ($60,000) and then bouncing back 19% within 24 hours as social sentiment reached capitulation levels.

This was accompanied by 66,940 BTC being moved to accumulation addresses in one day, an all-time high, indicating that institutional whale investors are actively protecting the $60K–$62K zone. “Bitcoin’s current MVRV Z-score of 1.2 indicates that Bitcoin is significantly undervalued, leaving little room for the price to drop substantially below the realized cost basis of $55,000,” McNulty said