- January 27, 2026

- Fareeha Mehmood

- 0

The silver market is experiencing an unprecedented increase in price. On February 8, 2026, silver futures contracts had their largest “single-day” advance, exceeding £27 million, with retail investors pouring into silver with more fervour than they did for “meme stocks.”

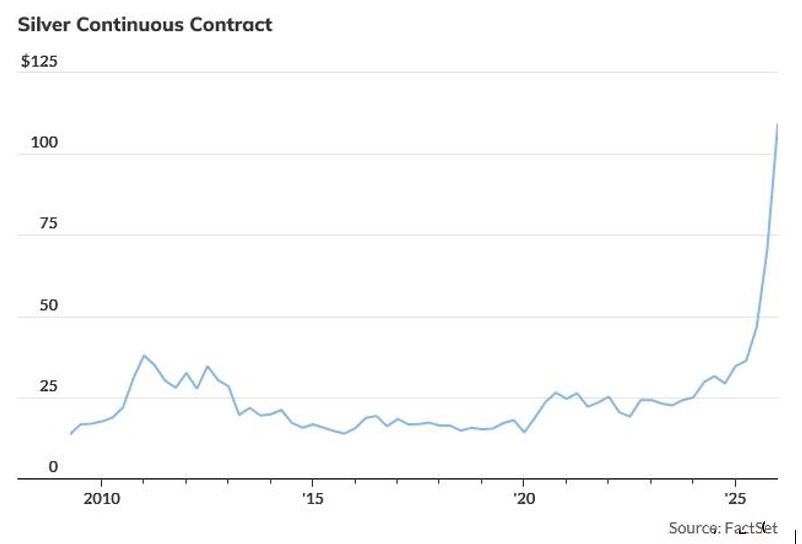

The level of excitement for this wave of silver trading far exceeded what was expected by many within the silver industry. Several of the metrics associated with silver, including its price, are at historical extremes, as evidenced by traders showing a cumulative 230% increase in silver futures prices during the beginning of 2025.

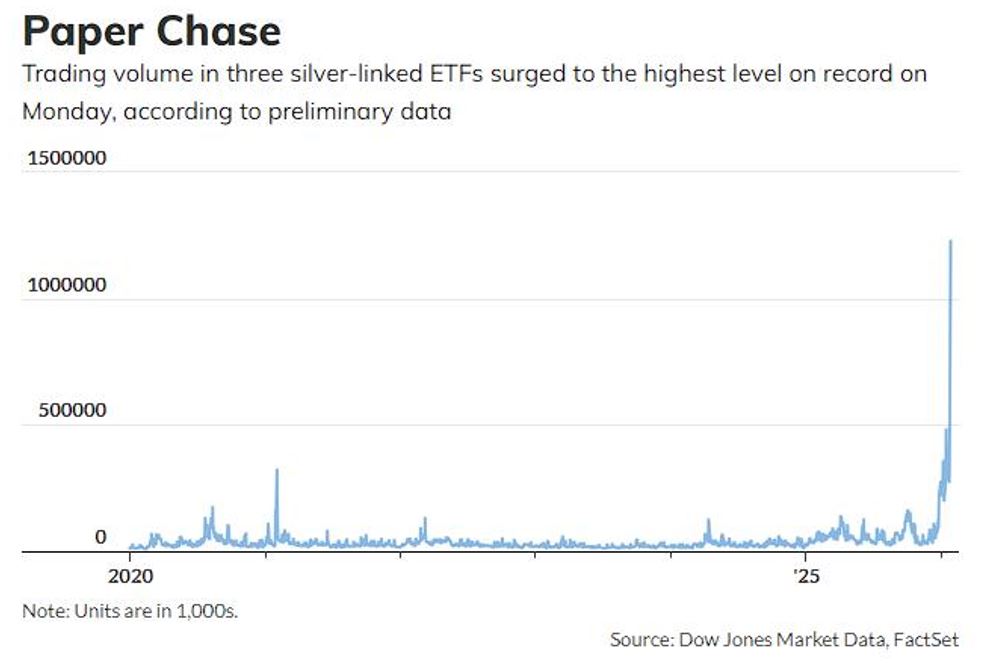

This powerful increase has eclipsed the performance of all other metals, including gold, and has been a primary force driving up the actual trading volumes of silver ETFs and their related option contracts.

According to Dow Jones Market Data, the most heavily traded exchange-traded funds in the U.S. on Monday were two silver ETFs. The most traded silver ETF by volume was the ProShares UltraShort silver ETF (ZSL), with approximately 800 million shares changing hands, which is a clear indication that several investors remain sceptical about the meteoric rise in silver prices and are making reverse trades with respect to silver.

In addition, the iShares Silver Trust (SLV) had a volume of over 377 million shares traded, placing it in second place in terms of the amount of trading activity on that particular day, illustrating that there is still a strong conviction in silver.

Also, the strategic triple combination of the three largest silver funds (the iShares Silver Trust, the Sprott Physical Silver Trust PSLV, and the ProShares UltraShort Silver ETF) resulted in a total record daily trading volume of more than 1.2 billion shares that day, creating an unprecedented peak in this same momentum of activity in the silver ETF marketplace.

Intense Market Volatility

With the influx of retail investors, the activation of leveraged funds, and the heightened emotional intensity, many market players are starting to question if “silver” is in a new cycle bull market or if it is a particularly emotionally driven financial bubble.

Howard Marks, billionaire founder of Oaktree Capital, states, “There are many types of bubbles in markets, but they usually have one thing in common; they are defined by people’s level of excitement becoming completely irrational for a concept.”

Howard’s description perfectly encapsulates the current position of the silver market. The emotional aspect is paramount, with the flood of investors joining in, as David Rowe, a market commentator, states, “This bubble is taking in all types of investors, trying to ride the wave.” Silver was once seen as a haven and is now viewed as “financial faith”.

There are still legitimate foundations to support the current rally, as there are market forces causing silver to increase in demand for such areas as electronics, defense, solar cells, and the long-term strain on the supply side.

Yet with every passing day, the emotional sentiment of the capital continues to grow hotter, causing many to warn that the control of trade is gradually shifting away from basic fundamental analysis and more toward momentum-oriented logic.

According to Daniel Ghali, Senior Commodities Strategist at TD Securities, “initially, price movement was a result of the imbalance in supply vs. demand, but now price has progressed into an emotion- and sentiment-driven bubble, without attachment to the fundamentals.”

He further stated that if you look at recent data, you will see the demand from the manufacturing industry for silver has been gradually decreasing over the past few months, while at the same time, the amount of retail buying, along with leveraged speculation, has been pushing the price of silver higher and overwhelming the fundamental supply and demand signals.

Specifically, the kind of price action that we are experiencing, once it enters into a parabolic move, tends to develop a self-reinforcing characteristic that will draw in even more forces. Additionally, the most recent data shows that implied volatility for silver has reached the point of being in a complete “loss of control” state.

Read: US Dollar Hits Four-Month Lows as Fed Decision Looms

The most recent LSEG Workspace data shows the VXSLSLV (Silver Volatility Index) is trading above 106 and intraday reached as high as 124. In regard to market expectation, this number indicates that investors are pricing in risk for daily price variation of approximately 7% (which is extraordinarily rare for traditional hard asset classes such as precious metals).

Based on the LSEG data, a significant number of investors and short sellers are currently in a panic mode and are buying upside volatility options to hedge against the short-term risks associated with the rapid increase in the market.

Therefore, from a technical perspective, silver currently resembles a trading vehicle that has been ignited by a momentum mentality rather than a “hard currency” asset. Some may argue this rally has occurred due to the influence of fundamental factors and therefore that technical analysis may be failing, but the reality is that there are numerous indicators that are flashing very extreme signals.

Is Silver Becoming “Meme-ified”?

Antonelli from Baird compared silver’s momentum to that of GameStop and stated that even though silver is an industrial commodity with sound industry fundamentals, recent trends do not justify the past months 65% price increase, as these fundamentals have not changed in a month. He said, “When prices start to skyrocket, regardless of barriers to entry, a rush to invest takes place. Once a trend starts, it is very difficult to stop it.”

Steve Sosnick at Interactive Brokers has expressed similar opinions about silver and its turbulent price motion. Although silver does not carry the same “retail vs. institutional” dynamics as meme stocks, the ongoing price run-up of silver is being driven by sentiment and trading momentum. His comments provide further insight into this immense price movement when he said, “The price movements of silver are typical of a market mania based on momentum trading and social trends and sentiment of the general public.”

The way silver has gained popularity as a meme trade is not a new occurrence; at the start of 2021, during the meme stock frenzy created by social media, silver was also a very popular asset for retail traders.

Silver’s recent resurgence as a result of the concerted efforts of many retail and short-term speculators has been characterised by a strong bandwagon effect. Analysts believe that silver’s long-term intrinsic value is because of its commercial use, relative scarcity, and increasing demand, while silver’s short-term price movements are more dependent upon trading patterns, feelings, and the fear of missing out (FOMO).