The global geopolitics is in turmoil as a result of the present-day Greenland conflict, which pits America against Europe, having an immediate effect on the like-crime cryptocurrency markets to date.

The cryptocurrency sector has had an extremely volatile event, characterised by a price drop of Bitcoin below $90,000 triggering a massive amount of forced liquidations. Over 183,000 leveraged traders have already been liquidated and total volume of liquidations is estimated at approximately $1.09 billion based on figures from CoinGlass.com.

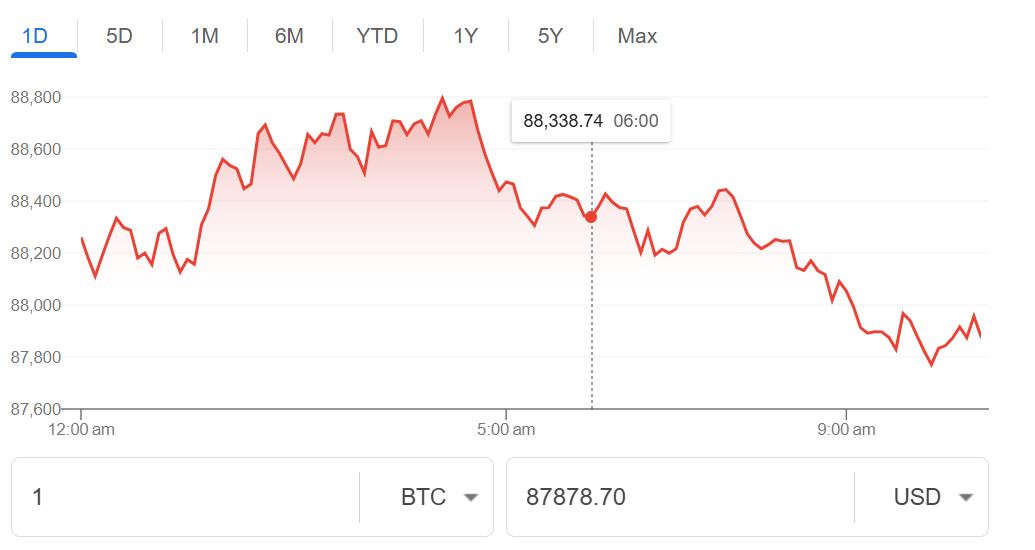

Broad risk aversion throughout the international capital markets has caused many assets in the crypto and traditional asset classes to exhibit similarly large declines in value just prior to this price drop. Bitcoin traded for as low as $88,746 at the point where it started to decrease from $92,500 late on Tuesday.

On Wednesday morning, Bitcoin trades at approximately $89,500. The data on the liquidation reveals that prior to the subsequent downfall, a high percentage (nearly 92% of positions that were forcibly closed) were long positions, indicating that traders had invested heavily in hopes of increased prices.

The largest single forced liquidation was for a BTC-USDT contract worth nearly $13.52 million on the Bitget exchange. A liquidation occurs whenever a broker-trader or trading platform closes an account and forces closure of a leveraged position, which occurs when the trader fails to keep required margins. Such forced liquidation events are generally indicative of significant market extremes (with regard to either direction), and therefore often foreshadow a potential price reversal in the near future.

The recent decline in prices throughout the cryptocurrency sector has coincided with increased downside action in US stock indexes, as the S&P 500 and Russell 2000 (the major US stock indexes) each dropped more than 2% following this decline. Each major US index suffered the market’s worst day since the beginning of October.

Stock prices related to cryptocurrency have also faced pressure recently. In particular, the price of the trading platform, Coinbase, dropped 5.6 percent, while Circle, a stablecoin issuer, lost 7.5 percent. Strategy, which is currently the most prominent institutional holder of Bitcoin, fell by 7.8 percent. BitMine Immersion, which has the largest Ethereum holdings globally, saw a 9.4 percent decrease.

Analysts have said that the main cause of the current turmoil across cryptocurrency markets resides in Japan. A significant selloff in Japanese government bonds led to a rise in ten-year securities’ yields of 19 basis points – the highest single-day rise in ten-year yields since 2022. While yields on thirty-year bonds experienced their largest single-day increases since 2003.

Read: Investors are worried as Market Awaits Clarity on Trump’s Greenland Threat

According to Kronos Research’s Chief Investment Officer, Vincent Liu, the drop in prices in cryptocurrency markets is being attributed to a macroeconomic environment that is becoming increasingly risk-averse and also the liquidation of leveraged positions causing a cascading effect of forced liquidations.

Furthermore, renewed tariff threats from U.S. President Donald Trump toward Europe also impacted market sentiment, as did the deterioration of the Japanese bond market and the decrease of U.S. pension fund holdings of Japanese government bonds. Investors noted a broad-based “Sell America” sentiment as stock prices, government bond prices, the U.S. dollar price decreased while the price of gold increased. Investors are watching the support levels between $87,000 and $88,000 closely; a break below these levels may signal that prices may continue to fall and test the $85,000 support level.

Possible changes in the future may now be heavily impacted by Japan’s snap election scheduled for February 8, which may produce a fiscal dominance situation and place the Bank of Japan back into a position of having to resort to quantitative easing, with the probability of this scenario being priced in at 91% in the Polymarket predictive market.

Other factors that investors will be paying close attention to include tariff developments, macro indicators from the Federal Reserve, and the flow of institutional capital into cryptocurrency ETF products.