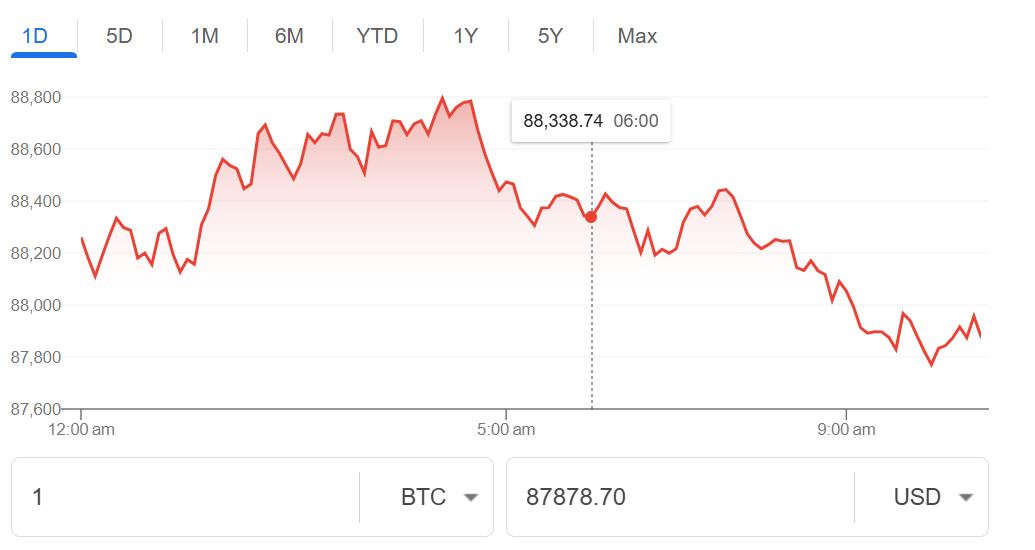

Bitcoin (BTC) has been below the $88,500 level in the early week as crypto assets fell, leading into an important period for crypto-related assets that is defined by the Federal Reserve’s decision on interest rates, together with many earnings reports from some of the world’s largest technology companies.

CoinDesk’s data indicates that Bitcoin traded at about $88,400 during Asian trading hours, which is slightly lower than its previous day and is down approximately 4% from the previous week. In comparison, Ether (ETH) traded near $2,940 while Solana (SOL), XRP (XRP), and Dogecoin (DOGE) also saw minor declines as risk continues to weigh heavily on all of the major token markets.

Silver (XAU) sold off at the end of U.S. trading today after it posted its largest one-day rally since 2008 based on the previous day’s extremes. Gold (XAU) fell from an all-time high of just over $5,000 as a result of extreme volatility in the price of both metals today. Additionally, despite the sharpest surge in Silver’s price of more than 14% during the day, which briefly pushed it past $117.10-per-ounce, it still closed on Monday with an increase of 0.6%, also marking its most significant daily price move since the global financial crisis.

Read: Bitcoin Falls Below $90,000 as Global Markets React to Bond Selloff

Conversely, many cryptocurrencies are struggling to take advantage of the gains seen by traditional markets. The most notable example being Bitcoin, which is still sitting well below its peak value of October, even though its falling true yields and continued weakening of the dollar, together with increasing geopolitical uncertainties, have bolstered gains in traditional equities and precious metals.

Currently, cryptocurrency exhibits a divergence, which has only added to the belief that crypto is not a hedge. Instead, crypto appears to behave more like a high-beta asset and is more correlated to liquidity and positioning. According to Alex Kuptsikevich, Chief Market Analyst at FxPro, in a recent email, “Cryptocurrencies are still considered to be a lagging class of risk-sensitive assets; thus, they are behind not only metals, but also behind the strongest global currencies.”

Furthermore, even with the recent gains in cryptocurrency over the past few hours, the “technical picture remains bearish”. Kuptsikevich notes that BTC has not attempted to breach its two-month support and continues to remain below its key moving averages. There is an anticipated outcome that the Federal Reserve will keep interest rates unchanged in the meeting occurring on Wednesday, and it is expected that some of the Magnificent Seven’s earnings are likely to determine whether or not the AI-induced rally in equities will continue.

Future momentum for cryptocurrencies will be based less on cryptocurrency-specific news and rather on how the markets react to the direction provided by the Federal Reserve and the report cards of the so-called ‘Big Tech’ companies. Until then, at this point in time, bitcoin appears to stay relatively flat and has been seen drifting lower and sideways while investors await better direction.