Once again, it is a global crypto trend, yet there is much positivity when it comes to big coins, e.g., Bitcoin, Ethereum, and in some cases, altcoins. The total market capitalization and as well as trading volume decreased at a level of 1.85 percent and 7.66 percent respectively in the last 24 hours to the level of 200.55 billion dollars. Crypto Fear & Greed Index is also fading into the value of Greed at 70 that shows that the investors continue to bet on risk.

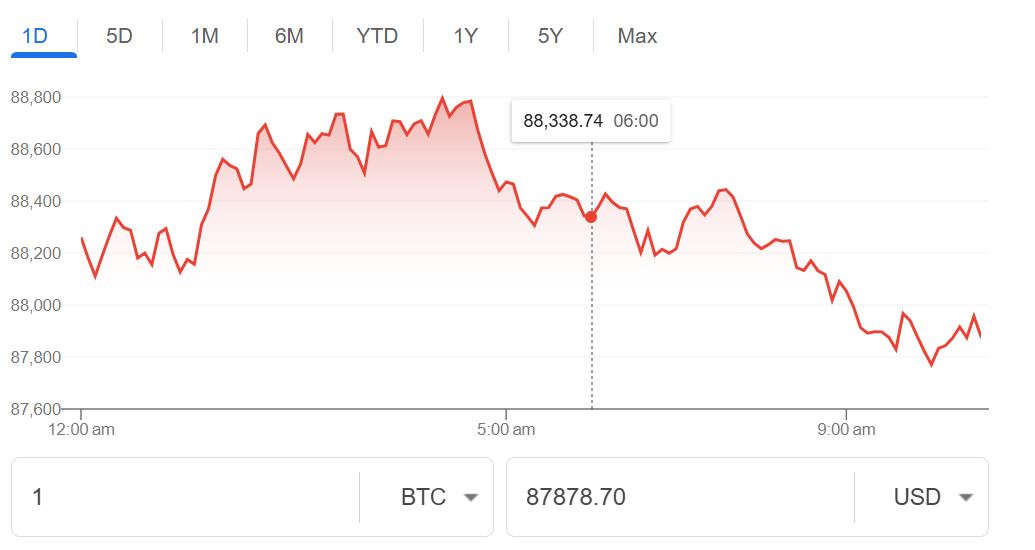

The growth of bitcoin (BTC) was 1.52%, which is why currently its price is almost the same as 118 980 dollars. Despite being bullish, it has declined a little in the market to a percentage of 60. This would mean that the altcoins are starting to count in. In the meantime, Ethereum (ETH) gained 1.06 percent and reached the price of $3,727, leaving the rest of 11.4 percent share of the dominance.

The largest surprises of the day were smaller altcoins. Such volatile actions evince an indication of how volatile and chance-ridden altcoin market still is.In terms of decentralized finance (DeFi), the overall values locked (TVL) rose by 0.92 percent to an amount of 140.62 billion.

Lido is still the leader in the segment of locked value with over 34.18 billion locked. Interestingly, Shido Dex registered the largest TVL growth within one day with an absolutely spectacular increase of 443,077 percent, implying a high amount of inflows or technical modification.

On the contrary, the NFT markets suffered. The total sales volume has decreased by 13.73 percent to 23.59 million, but CryptoPunks proved to be the exception to the rule and rocketed by 42.98 percent, to almost 1.9 million.

Regulatory and Institutional Moves

Globally, some key developments are shaping the market:

- The Financial Supervisory Service (FSS) in South Korea prohibited asset managers to include crypto-related equities such as Coinbase and Strategy in their ETFs portfolio.

- In Australia, listed on the ASX, DigitalX has been granted 8.8 million dollars worth of BTC, and its total supply now stands at 500 Bitcoin.

- According to the information in the U.S., the SEC was allegedly lobbied by billionaire Ken Griffin of Citadel to extend the same treatment to tokenized stock as it does to normal securities a step that may allow the further usage of tokenized stock.

Final Thoughts

The crypto market remains a bit optimistic. Bitcoin and Ethereum are resisting, and DeFi is regaining without haste. In the meantime, micro-cap tokens and meme coins such as $LVN, $SWOL, and others are giving speculative traders some fireworks. The headlines about regulatory crackdowns and institutional cartwheels are two underlying developments to monitor as the next act in the crypto storyline is rolled out.